First, the MBA Mortgage Applications information is based on data received from retail lenders (generally your typical bank or credit union), but the number excludes mortgage applications from wholesale brokers (your LendingTree, Guaranteed Rate, etc.). You may be aware that many mortgage brokers recently have closed their doors amidst the mortgage market turmoil. This means that many customers who normally would have visited that broker have been forced to visit their local banking institution to obtain a mortgage, effectively increasing the number of applications that are counted. In theory there could be the same number of people applying for a mortgage, but many more of them are applying at retail lenders (which are counted in the figure) versus brokers (which are not counted in the figure).

Another item to note is the number counts all applications, whether they are approved or not. Say Joe Schmo goes into his local bank branch, applies for a mortgage, and gets denied. Maybe he does the same thing again the next day. And again the next day. All three of these applications are counted in the MBA Mortgage Applications number. With credit tightening, more people might be getting denied on their first application and going back a second time before they qualify, increasing the number of mortgage applications counted.

So while the MBA Mortgage Applications number is a little skewed, don't let that turn you off of the housing market.

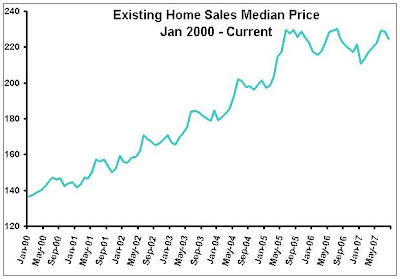

It is a GREAT time to buy: housing inventories are at incredible highs, meaning that as a buyer you have many more choices available to you. Additionally, many developers and sellers have begun slashing prices to sell more quickly.

If you're looking to sell and then buy: while the average time to sell has been a little slower in this market, if you're priced correctly, you will be able to sell. Illinois sales prices are still up from this time of year in 2006 so on the average there are still profits to be made. Say, for example, homes just like yours are going for $15k less than you were hoping to sell for. Well, if you sell for that $15k less, you'll still make up for it on the other side - when you turn around and buy your next house discounted by $15k or maybe more!

No comments:

Post a Comment